The UK government is currently weighing up the pros and cons of introducing taxation pertaining to the sale of disposable vapes. This has become a matter of pressing concern following recent reports of associated E-Waste, as well as a marked rise in use amongst younger populations. The Department for Health and Social Care (DHSC) has suggested taxation as a way to potentially decrease underage vaping and limit the amount of E-Waste generated by them. In this article, we will explore the possible impact of taxation on disposable vapes in the UK.

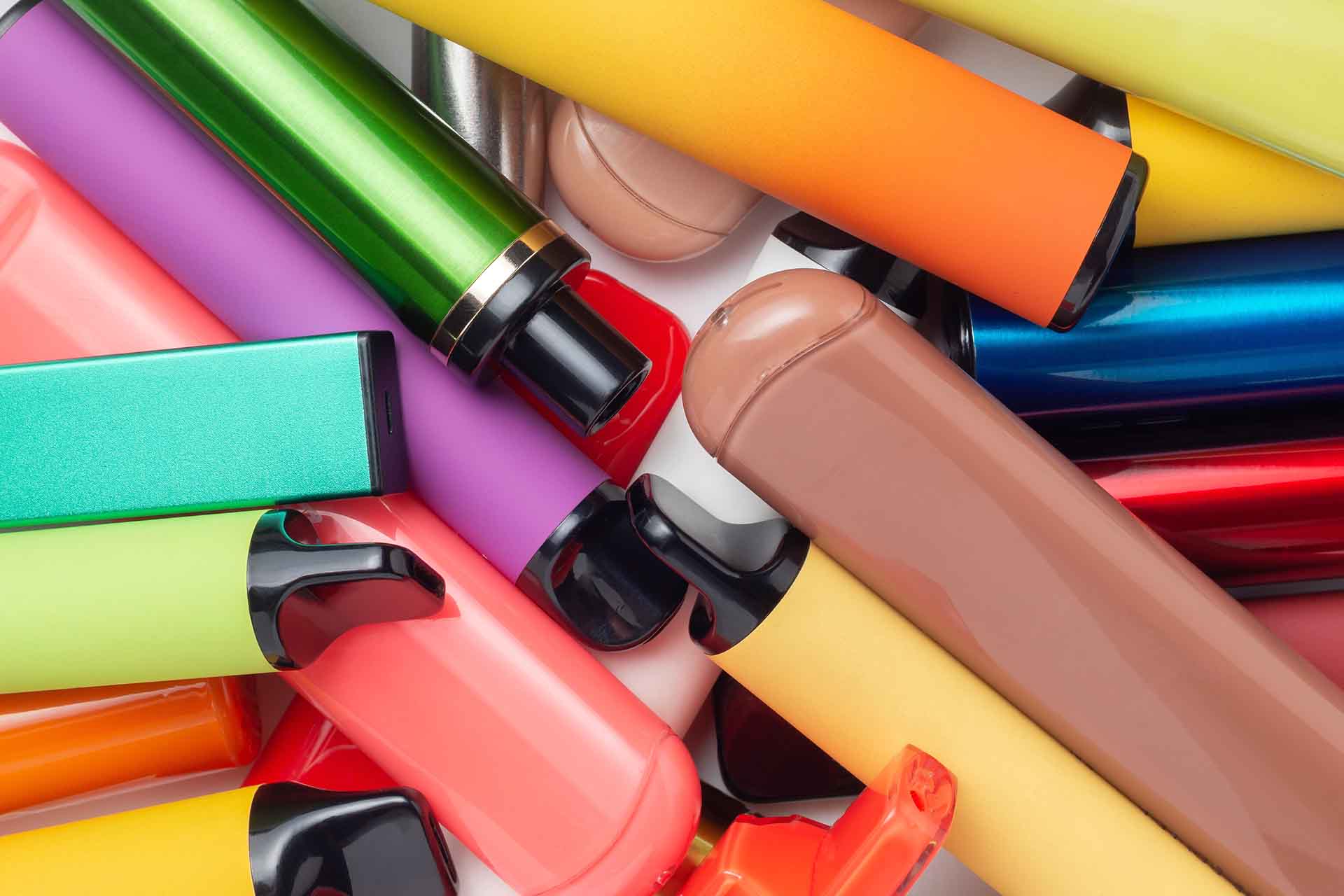

Overview of Disposable Vapes

Disposable vapes are electronic cigarettes that are designed to be used one time and then thrown away. They offer a quick and convenient way of smoking, but they also come with a significant amount of waste associated with them. This has sparked alarm amongst certain quarters, leading the UK government to consider potential solutions, including taxation.

Recent reports of associated E-Waste have put the issue in sharp focus. An estimated 1.3 million disposable vapes are thrown away every year in the UK alone, with much of it ending up in landfills or littering streets and waterways. This is concerning as many disposables contain toxic chemicals that can be harmful to humans and the environment.

At the same time, recent studies point to a rise in usage amongst younger populations. This has been attributed to marketing tactics that target young people, as well as the perception of disposables as being less harmful than other forms of smoking. As such, this has spurred on the further discussion about potential solutions, including taxation as an effective tool for curtailing disposable vape usage.

UK Government considers Vape Taxation

In response to these concerns, the UK government is currently exploring potential solutions pertaining to the perceived issues surrounding disposable vapes. This includes examining the possibility of introducing taxation as an effective tool for curbing disposable vape usage.

The Department for Health and Social Care (DHSC) has suggested the introduction of taxation on disposable vapes as a way to potentially decrease underage vaping and limit the amount of E-Waste generated by them. While this is an intriguing potential solution, there are still many factors that need to be taken into consideration when it comes to introducing taxation on disposable vapes.

For example, one must consider the potential cost associated with such a move and its impact on disposable vape manufacturers, disposable vape retailers and disposable vape consumers. It is also important to consider the potential for unforeseen consequences if such a tax is implemented.

Benefits of Taxation on Disposable Vapes

Despite the potential drawbacks, taxation could be an effective tool for curtailing disposable vape usage. One of the main goals of introducing a disposable vape tax would be to make vaping more expensive and thus reduce usage amongst young people. It could also be a tool to limit the amount of disposable vapes that end up in landfills.

In addition, taxation on disposable vapes could be a way to generate revenue for the UK government. This money could then be used to fund initiatives that would help increase disposable vape recycling or fund smoke-free initiatives.

Drawbacks of Taxation on Disposable Vapes

There are, however, some drawbacks to imposing taxation on disposable vapes. One major issue is that it could be costly for disposable vape consumers as the cost of disposable vapes would likely increase. This could lead to people switching to less expensive traditional cigarettes, thus negating any positive effects associated with such a move.

Another potential issue with this type of taxation is the possibility of creating a black market with cheaper un-taxed variations imported from overseas. This in itself can be risky not only to those who use such products, but honest manufacturers and brands.

Ultimately, it is up to the UK government to assess the pros and cons of introducing a disposable vape tax in order to decide if it is an effective tool for curbing disposable vape usage and E-Waste. While taxation could be a viable solution, it is important to consider all the potential implications before implementing such a measure.

In conclusion, disposable vapes have been linked to an increase in reports concerning disposable vape waste, as well as a rise in usage amongst younger populations. This has led to the UK government exploring potential solutions, including taxation, as an effective way of curtailing disposable vape use.

For the vaping industry, a tax introduced onto vaping products could be problematic or help steer brands towards more sustainable forms of vape products. What do you think? Let us know in the comments below.